Who doesn’t love an episode of Antiques Roadshow where some old biddy discovers that the little brooch she found in her attic is worth a small fortune? Or a rummage through a second-hand shop in the hope you might come across that rare, unnoticed Rolex that you can grab for a fiver and sell for a fortune? These things hardly ever happen, but that’s not to say that watches and jewellery are some of the most collectible commodities on the planet right now. Given that they comprise precious metals and minerals, in themselves of intrinsic worth, they already have an investable element in their makeup. Add scarcity (a limited edition release, say, or needing to stew on a waitlist for months, or a one-of-a-kind piece), sentimentality (a commemorative launch around an occasion like the coronation or the Olympics) and pedigree, and you’ve got grounds for serious collectibility.

If there’s one thing that will really hike up the price of a jewel or watch, it’s provenance — and the more famous the previous owner, the better. Just look at the estimate-breaking figures obtained for the jewellery collections of women like Elizabeth Taylor, Lily Safra and Bunny Mellon, which all smashed pre-auction price expectations. And don’t even start on pieces with royal provenance — you almost need to be royalty to enter the auction race.

Don’t think, however, that watches and jewellery are investments only for the exceedingly wealthy. These days the resale market for ‘hard luxury’ (watches and jewellery compared to clothing and handbags) is huge business. Last year’s global market for pre-owned watches and jewellery was estimated to be around 36 billion euros. Secondhand e-tailers like Vestiaire Collective, The RealReal, and even Ebay are competing with an increasing number of specialist dealers in pre-owned products, often associated with the brand itself.

Take Van Cleef & Arpels, whose Heritage Collection is now shown at luxury art fairs like TEFAF in Maastricht, the Netherlands, the rooms of which are filled with extraordinary objects (antique Japanese armour, ancient baroque statues, renaissance-era tapestries). “We realised that many of our clients who want to buy vintage Van Cleef & Arpels want the reassurance of buying directly from us,” says Nicolas Luchsinger, Heritage Collection Director, who will often be called on to view a particular piece lounging in a safe somewhere in Geneva or New York City. Heritage Collection pieces range from bijoux little animal brooches from the 1950s (very in demand in Asia) to a stonking great emerald necklace from the 1970s.

Cartier has a similar program, Cartier Tradition, whereby vintage items are sold both in store, and via globe-trotting trunk shows to high net worth clients. The house takes every care to restore vintage watches and jewels to pristine, authentic condition, often buying old pieces from clients who are looking to invest in something more contemporary, or from dealers who may have purchased directly from previous owners. These people aren’t just upgrading or getting a seedy cash-back offer — they’re making money on their former purchases like they would any other astute investment.

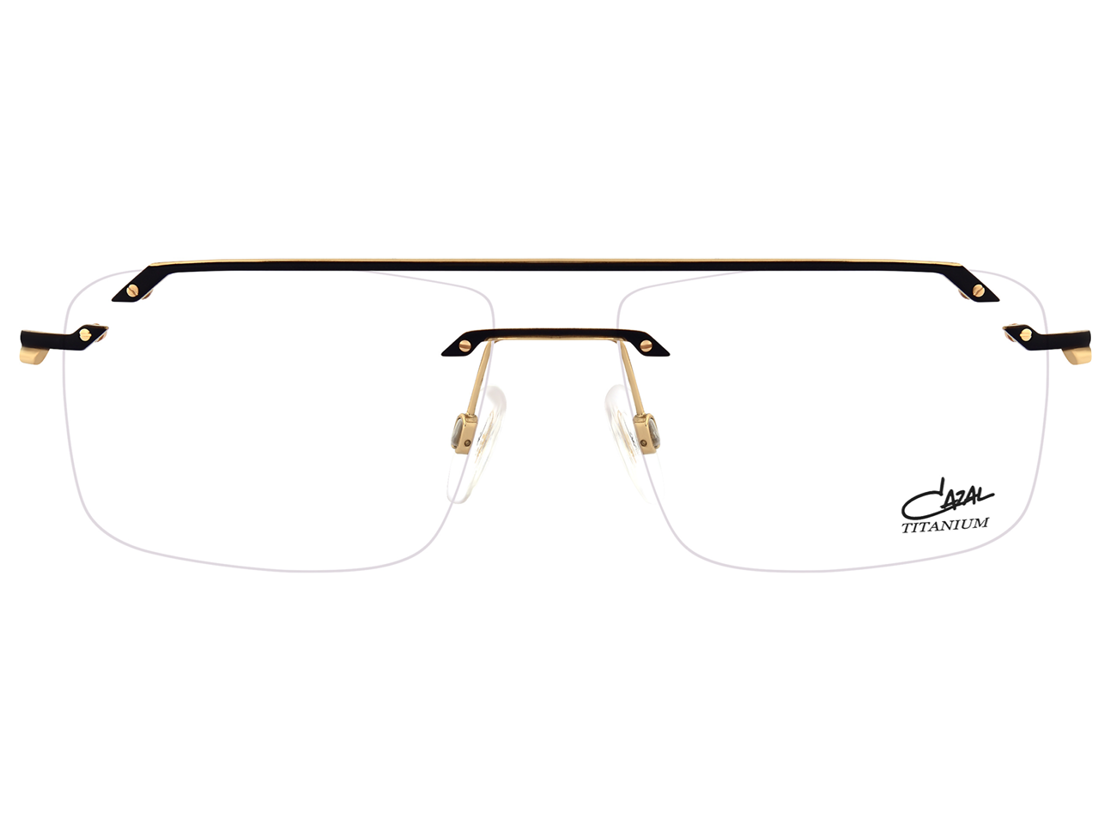

Chiefer Appiah, a London jeweller and watch dealer who specialises in blinging up high end watches from the likes of Rolex and Audemars Piguet for a largely celebrity clientele, says investing in certain models is a no-brainer. “If you can get hold of a new, limited edition Rolex, buy it. You could sell some models for a 30 percent profit within six months.” Rolex itself now has a certified pre-owned platform, where customers can buy a second-hand watches with its authenticity vouched for, and a two-year guarantee.

It may seem like easy investing — but the reality is, many of these in-demand watches are not easy to buy because they’re in demand. If a model has been discontinued, released as a limited edition, or featured in a Bond film, it becomes collectible, and thus, an investment piece. The same goes for jewellery; rarity is everything. No collector is going to pay more than the market price for a Cartier Juste Un Clou ring when they’re everywhere, but a one-of-a-kind high jewellery suite in chalcedony and sapphires from the collection of philanthropist billionaire Heidi Horton? Get your auction paddles ready.

What makes watches and jewellery so collectible for so many of us, however, is not their intrinsic value, but their ability to reflect our individuality. I have a tiny porcelain pendant with the words “Fuck This Shit” hand painted on them amidst tiny blue flowers, reminiscent of a Victorian greeting card, by the artist and jeweller Kerchung Creative. It cost about NZ$60, but the only way to buy one is to be the fastest person online when she drops a new collection every few months. Many, many people I know have failed, and I’ve refused some impressive cash offers to part with mine. That, and my grandmother’s charm bracelet from the 1940s. Also of little financial worth, it’s worth everything to me in terms of meaning, which is probably the most hard-to-buy quality of all.